Expert View: Impact of Union Budget 2023-24 on Personal Finance

What's the difference between the old and new tax regime? Is the union budget 23 beneficial for seniors? Financial expert and Silver Talkies member Dr Pallavi Mody shares her views.

1. Confusion between the two tax regimes: Which is better, new or old? According to the old regime, for years, we have been persuaded to use the tax exemptions for paying life and health insurance premiums, PPF, NPS, interest on housing loans etc. It was a policy framework where the government was nudging people to save in the desired directions. In a way, it was good as it led to compulsory saving, and one got into the habit of saving early in life. According to the new regime, we are now mature and can take our own decisions regarding consumption-saving-investment—no tax exemptions except standard deductions. Do what you want with your money; consume, save, and invest. It is your choice!

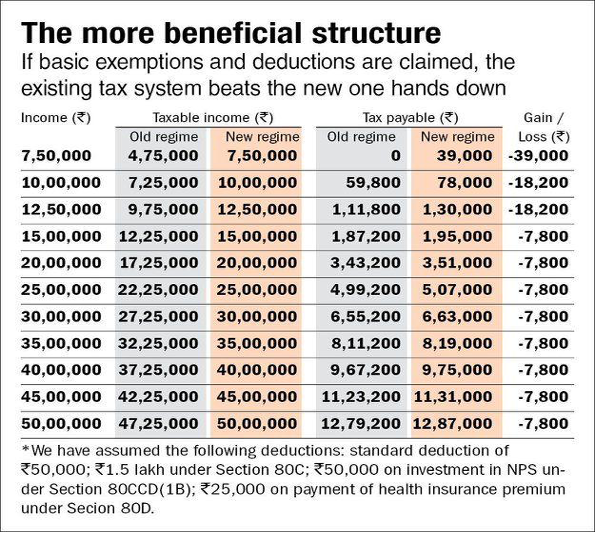

A math is done for you to decide which regime you would like to choose. If you take the above-stated exemptions at higher incomes, then the old regime is marginally beneficial. The old regime would lead to substantial gains if you could take more exemptions like interest on housing loans and Mediclaim for family. The new regime has been made default, and it looks like we will have only the new regime by the next budget.

2. Will the budget proposal cheer the Senior Citizens?

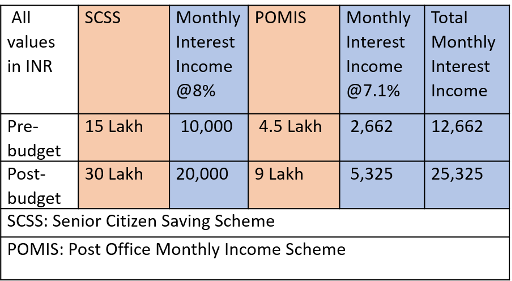

Falling interest rates, inflation and rising life expectancy have been crushing senior citizens under financial stress. After a long time, the government has recognized the pain, and the budget has doubled the investment limit for Senior Citizen Saving Scheme (SCSS) and Post Office Monthly Income Scheme (POMIS).

A little math is done here to understand the difference in the income that the silvers would receive. The scheme is open to investment for both husband and wife. A monthly income of Rs. 50,650 by investing Rs. 78 Lakh (in two accounts) would be available, which would be risk-free and hassle-free. Considering the comfort levels of silvers for the Fixed income instruments compared to the Mutual Funds, this measure would go a long way in helping them. There is a caveat, the interest income is taxable, so if the other income is high and if they fall in the bracket of more than ten lakhs, they are liable to pay tax.

3. The impact on High Net Worth Individuals (HNIs)

On one hand, the finance minister (FM) has rewarded the HNIs by lowering the highest surcharge rates on income above Rs. 5 crores from 37% to 25%, which will reduce the Maximum Marginal Rate of tax from 42.74% to 39%.

A progressive tax system where the rich pay a higher tax at a higher rate has been part of the Indian tax system to address the issue of income inequality. Besides the regular income tax slabs, there is a provision of surcharge for High-Income earners. Between Rs. 50 lakh and one crore, one pays a 10% surcharge, between one crore and two crores 15% and so on.

On the other, the government has plugged the loophole in the three avenues where major evasion of capital gains tax took place.

Life Insurance with single premium policies attracted many HNIs to buy high-value policies to get risk-free attractive returns. The government feels that insurance policies cannot be treated as investment options. Now, Life insurance policy proceeds would be taxed-except in case of death. Proceeds of any insurance policy issued after April 2023 where the premium is more than Rs. 5 lakh per year would be added to taxable income. What is worse, it would be taxed at a marginal tax rate. So, for an HNI, 30% of the proceeds would be taxed.

Real estate investment provided a tax shield to HNIs. They could invest the gains they made in stocks, gold, real estate, and start-ups and save on capital gains tax by investing in real estate. The budget proposes to cap the deduction from housing property at Rs.10 crores. This new provision seeks to prevent huge deductions claimed by the HNI assesses after purchasing very expensive residential property.

High net-worth individuals tend to pick Market Linked Debentures (MLDs), given the tax treatment they attract. MLDs are listed securities and are currently being taxed as long-term capital gain (LTCG) at 10% without indexation. The Budget has said that the capital gains on market-linked debentures (MLDs) will now be taxed as short-term capital gains.

Would you like to share your views? Respond in the comment box below

Comments

C Raghu

16 Feb, 2023

Thanks Dr Pallavi for the very useful information.

Lakshmi Raman

16 Feb, 2023

Thank you Dr. Pallavi. Your article is very helpful to draw a comparison between the old and new tax regimes.

Padma

16 Feb, 2023

very informative & useful for me.

Post a comment